MEDIA RELEASE

May, 15, 2024 – Victoria BC – With many consumers facing financial woes, none may be as hard hit as millennials, the generation born between 1981 and 1996. For this reason, Consumer Protection BC has millennials in mind for their latest education campaign focused on debt and borrowing.

Consumer Protection BC’s data showed that millennials were the least confident and the most stressed about debt compared to other generations in BC. These findings support other Canadian research that indicated this generation had the highest increase in non-mortgage debt levels in Canada between 2021 and 2022.

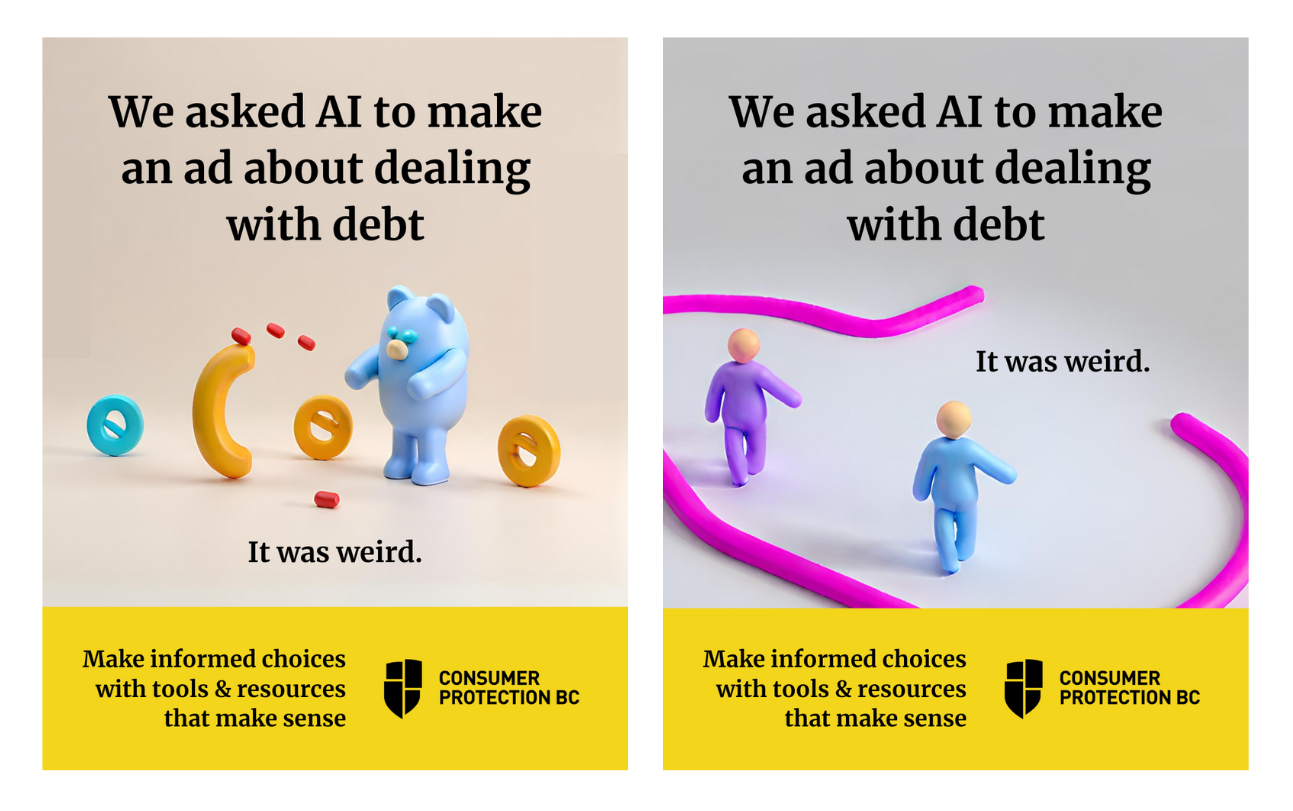

To reach a millennial audience in a market flooded with information and ads about debt, Consumer Protection BC knew they needed a way to stand out. So, the regulator used AI to generate the visuals in their ads and the results were… interesting:

“The images are weird and silly,” says Tatiana Chabeaux-Smith, Director of Communications with Consumer Protection BC. “Being in debt can be emotionally taxing and we knew we didn’t want a somber tone for our campaign. We’re taking a chance that our millennial audience will find the concept amusing and be encouraged to explore the resources we have to offer.”

The campaign draws a parallel between the strange AI-generated images and the confusion that exists around debt and borrowing information.

“While there’s no lack of financial advice in the marketplace or on the internet, finding straightforward and unbiased information can be hard” says Chabeaux-Smith.

Consumer Protection BC is responsible for enforcing certain consumer protection laws in the province including certain rules for debt collection, payday loans, and debt repayment.

The educational campaign provides accessible tools and resources to help consumers learn and exercise their debt and borrowing rights in BC. The website also helps consumers compare different debt resources and learn where to go for help.

When asked what advice she has for BC millennials struggling with debt, Chabeaux-Smith encourages them to visit the Consumer Protection BC website and to familiarize themselves with the options that are available to them.

“You’re not alone, you have rights, and there are resources that can help.”

Consumer tips

- If you’re getting collection calls, you have rights in BC. The laws outline when a debt collector can contact you and how they can communicate with you. For example, you can request that collectors communicate with you in writing only or you can dispute a debt through the courts if you don’t believe you owe it.

- If you decide to borrow money from an online payday lender, check that they are licensed to operate in BC. Borrowing from unlicensed lenders can cause long-term financial risks.

- Understand the cost of your loan by knowing the annual percentage rate, how the interest is calculated, and the length of the loan term.

- If you’re trying to pay down debt and need help, be proactive and get help when you need it. Do your research and compare your options before deciding on a debt relief company.

Explore all Consumer Protection BC’s tools and resources to make informed debt and borrowing choices by visiting their website: www.consumerprotectionbc.ca/debt

Debt and borrowing in BC

Making decisions about debt and borrowing can be stressful and confusing. There’s a lot of information out there and it’s hard to know what to trust. Make informed debt and borrowing choices with tools and resources that just make sense.

About Consumer Protection BC

Consumer Protection BC is a not-for-profit regulator that’s responsible for certain rules for credit reporting, debt collection, payday loans, high-cost loans, and aspects of debt repayment services. Find out more about Consumer Protection BC and the other industries and transactions they oversee by exploring their website.

– 30 –

Media contact:

media@consumerprotectionbc.ca